Biweekly plus extra payment mortgage calculator

Although your payment is technically late most mortgage servicers wont give you a late payment penalty after only a day late because of the mortgage grace period which is the set time after your due date during which you can still make a payment without incurring a penalty. This mortgage calculator allows you to choose between monthly and bi-weekly mortgage payments.

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Years to pay off.

. Bi-weekly payments are another popular way to pay extra on a mortgage. Mortgage Amount or current balance. The required Monthly Payment plus any Additional Principal you want to pay each month.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. A Pr1rn 1 rn 1 2. For accelerated payments youre paying an extra 2000 per year equivalent to an extra monthly mortgage payment.

The extra payment options are a one-time extra payment recurring biweekly monthly quarterly and. Extra payment calculator with payment schedule calculates interest savings due to one lump sum or multiple extra payments. Their investment GAIN will be 81238.

The more youve paid toward your mortgage the more equity in your house you own. This is comparable to 13 monthly payments a year which can result in faster payoff and lower overall interest costs. These include making lump sum payments or shifting to a biweekly payment schedule while making additional payments.

You can also use the calculator on top to estimate extra payments you make once a year. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. The additional amount you will pay each month over the required Monthly Payment amount to pay down the principal on your loan.

Our calculator includes amoritization tables bi-weekly savings. Another true bi-weekly payment calculator. 1264 Total interest paid on your loan.

The amount is larger than a regular biweekly payment which lowers your principal faster. 30 years Monthly payment. 250000 Deposit 10 25000 Mortgage balance.

Many other variables can influence your monthly mortgage payment including the length of your loan your local property tax rate and whether you have to pay private mortgage insurance. Below is the formula for an accelerated biweekly payment. To understand how this works lets compare a regular loan with loans using a biweekly payment and an accelerated biweekly schedule.

Loan Original Payment. This extra mortgage payment will pay down your mortgage principal faster meaning that youll be able to pay off your mortgage quicker. 30-Year Fixed Mortgage Principal Loan Amount.

Introductory Mortgage 5-year Fixed-rate Home price. 1 day late. Prints yearly amortization tables.

Its Easier to Budget. Most mortgage payments are due on the first of the month. Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

The Early Payoff calculations assume you will. Starting from the first year of your loan. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the.

Plus remortgaging before your introductory period ends requires early repayment charges. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Make extra mortgage payments each year.

Bankrate is compensated in exchange for featured placement of sponsored products and. To show you how remortgaging works heres an example. You can still boost your mortgage even if you make extra payments after a couple of years on your mortgage.

This calculator will calculate the weekly payment and associated interest costs for a new mortgage. Since a bi-weekly plan results in 13 annual payments making that extra 13th payment can trigger the penalty. The loan is secured on the borrowers property through a process.

Use our free mortgage calculator to estimate your monthly mortgage payments. Given that there are 12 months and 52 weeks in a year paying 26 bi-weekly payments is like paying 13 monthly payments with the 13th payment going entirely toward the principal of the loan. Account for interest rates and break down payments in an easy to use amortization schedule.

Bi-Weekly plus Extra Mortgage payment. How we make money. Youre probably familiar with refinancing but you may not have heard about mortgage recastingWhen recasting you make one large lump-sum payment toward your principal.

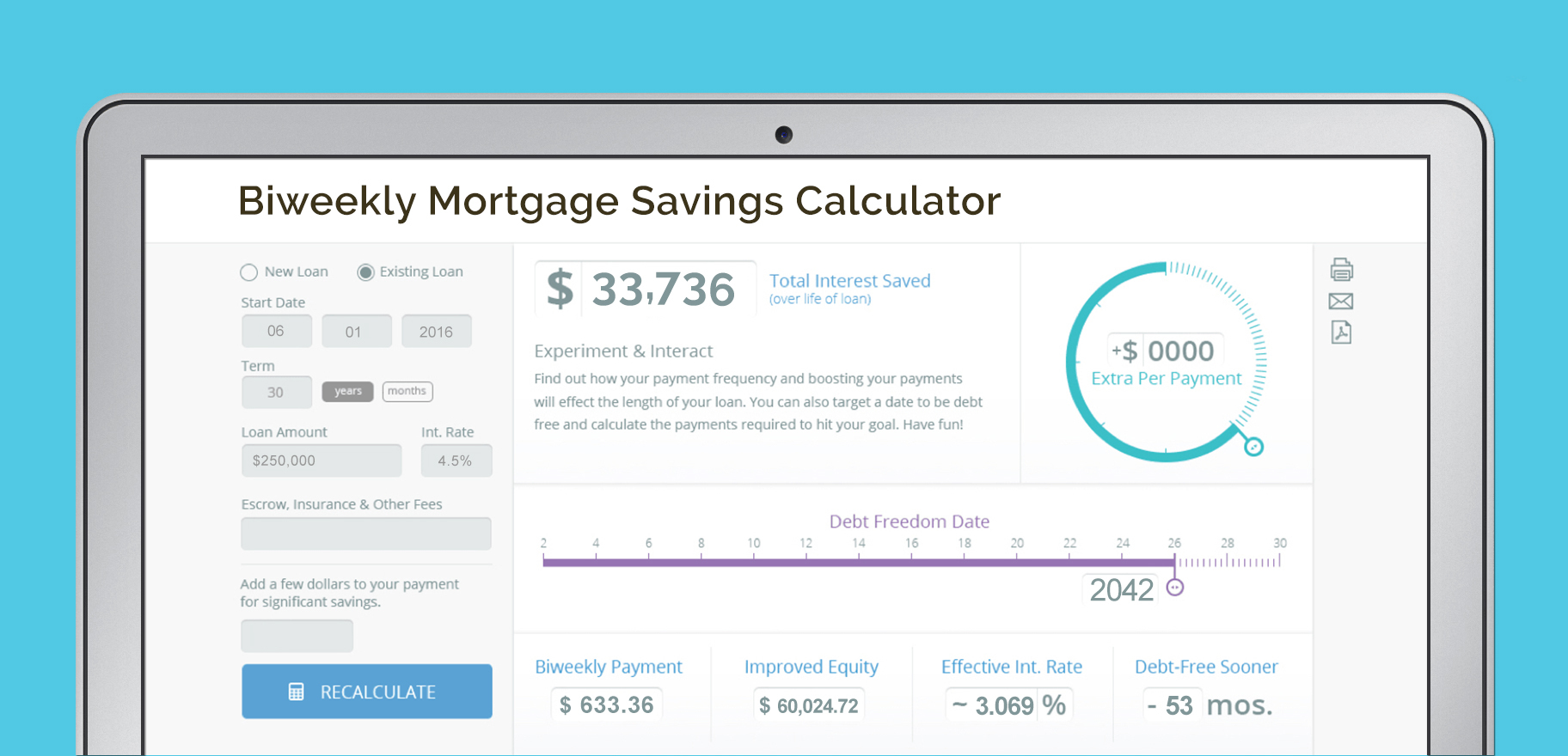

The mortgage calculator with extra payments gives borrowers four ways to include extra payments for their payments in case they want to pay off their mortgage earlier. If youre still confused whether this payment option is best for you use the biweekly mortgage calculator above to help you see the total savings that you could be getting. Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per year.

To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. While each payment is equal to half the monthly amount you end up paying an extra month per year with this method. Expensive penalty charges can dwarf any savings you make from bi-weekly payments.

If you are paid biweekly then having a biweekly mortgage payment can make it easier to budget. For example if you pay 1200 once per month as your entire monthly mortgage payment youre currently making monthly mortgage payments of 14400 per year. Similar to making biweekly payments you can simply make an extra mortgage payment once a year or pay an additional amount each month 250 more for.

Is approaching 400000 and interest rates are hovering around 3. Equity after 5 years. Thus you must prepare your finances thoroughly before you decide to remortgage your home.

Checkout this loan and mortgage payoff calculator. Equity after 10 years. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Check out the webs best free mortgage calculator to save money on your home loan today. Interest can add tens of thousands of dollars to the total cost you repay and in the early years of your loan the majority of your payment will be interest. Extra Payments In The Middle of The Loan Term.

Total value of the investment account will be 55000 in extra payments invested plus the 81238 gain equals 136238. When you change to biweekly payments youll make payments every two weeks. By always having the same amount going toward your mortgage.

Advantages Disadvantages of Biweekly Payments. With bi-weekly payments you pay half of the monthly mortgage payment every 2 weeks rather than the full balance once a month. By making an extra payment each year youll gain equity more quickly.

Mortgage Acceleration Calculator Freeandclear

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Bi Weekly Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Excel Templates Mortgage Payment Calculator Mortgage

Virginia Mortgage Calculator Mortgage Rates Today

The 6 Best Mortgage Calculator Plugins For Wordpress Interserver Tips

Biweekly Mortgage Calculator How Much Will You Save

The 6 Best Mortgage Calculator Plugins For Wordpress Interserver Tips

Biweekly Mortgage Calculator How Much Will You Save

Best 10 Mortgage Calculator Apps Last Updated September 9 2022

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator Apps On Google Play

Mortgage Calculator With Extra Payments On Sale 54 Off Www Ipecal Edu Mx

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Calculate My Mortgage Payment Online 59 Off Www Quadrantkindercentra Nl

Autopayplus Redefines The Crowded Online Mortgage Calculator Space Business Wire